Diversifying one’s sources of income is one of the most important steps one can take to ensure long-term financial development and stability. If you only have one source of income, you run the risk of suffering from unanticipated difficulties as well as changes in the economy. Exploring different ways to make money in an age of fast-shifting financial landscapes may not only strengthen your financial resilience but also open up prospects for wealth building. This is especially true in an era in which the financial landscape is changing at a rapid rate. This post goes into a variety of useful tactics and recommendations that can assist you in efficiently diversifying your sources of income. Whether you’re trying to supplement your primary income, generate passive income, or start a side hustle, we’ll discuss essential ideas and concrete methods to guide your financial journey toward continuous development and financial stability. This is true regardless of whether you want to generate revenue in a passive manner, augment the income you already have, or launch a side business.

| Table Of Contents |

| Understanding where you stand financially will provide a solid foundation for diversification! |

| Identify new income opportunities and explore various income-generating possibilities! |

| Diversifying your investment portfolio can reduce risk and potentially yield higher returns! |

| Develop income streams that require minimal ongoing effort, such as online businesses! |

| Enhance your skillset through education and training to increase your earning potential! |

| Manage debt effectively by reducing high-interest debt to free up funds! |

| Multiple revenue streams in your current career! |

| Regularly assess your income streams and make adjustments as needed to stay on track toward long-term financial growth! |

| In Conclusion! |

Understanding where you stand financially will provide a solid foundation for diversification!

The first and most important stage in the process of diversifying your revenue sources for the purpose of long-term financial growth is to have an understanding of your existing financial condition. The act of taking this knowledge with you before embarking on a journey is like to carrying a map with you; it assists in guiding your decisions and makes certain that you remain on the correct path.

To get started, conduct a thorough analysis of your sources of income, ongoing monthly spending, outstanding obligations, and any assets or savings you already have. Your current state of financial wellbeing will become crystal evident after reviewing this in-depth analysis. It will show you if you have excess cash available for investment or whether you need to prioritize the reduction of debt before exploring other channels of income.

It is essential to have a clear grasp of your financial objectives, both short-term and long-term. Do you plan to purchase a home, put money away for your children’s education, or put money away for your retirement? Income diversification may need to be approached differently depending on the goals that are set.

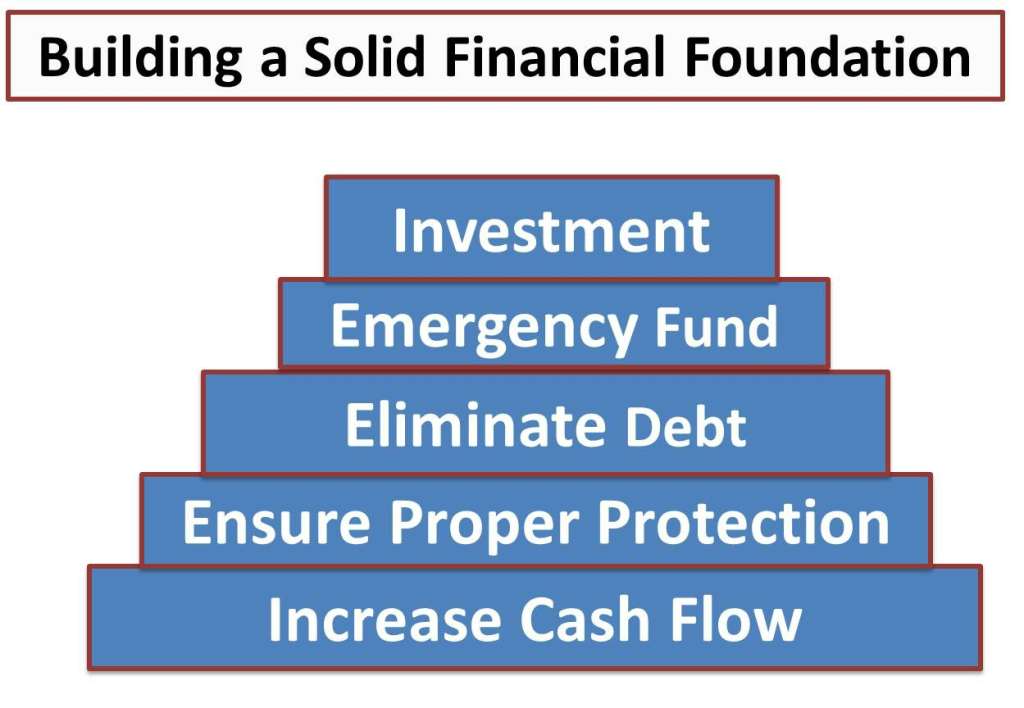

Having this level of financial self-awareness not only assists you in locating the appropriate sources of income but also gives you the drive and discipline that are essential for successfully putting your diversification plan into action. It creates a solid foundation for sustainable financial success by ensuring that your financial decisions are aligned with your overarching goals.

Identify new income opportunities and explore various income-generating possibilities!

To achieve both financial stability and development, one of the most important steps is to discover new revenue prospects and investigate a variety of income-generating alternatives. It can be dangerous to put all of one’s financial eggs in the basket of a single revenue stream in today’s uncertain economic climate. In order to reduce the impact of this risk, you should explore a variety of prospective revenue-boosting opportunities and cast a wide net.

Begin by carrying out extensive research and doing a study of the industry in order to locate developing trends, niche markets, or high-demand industries in which you may leverage your talents, hobbies, or experience. Investigate the possibility of finding employment in the gig economy, as a freelancer, or in part-time positions that play to your skills.

You should think about the possibility of making investments in things like stocks, bonds, real estate, or even beginning a small business or a side hustle. These businesses not only have the ability to bring in additional revenue, but also provide the possibility of wealth growth over time.

Keep in mind that in order to successfully diversify your sources of income, you must be prepared to adjust, learn, and welcome change. To pursue economic advancement successfully, you need to have a growth mindset and be receptive to new possibilities at all times. You can build a more secure and successful financial future for yourself if you keep an eye out for new income opportunities and give them careful consideration.

Diversifying your investment portfolio can reduce risk and potentially yield higher returns!

In the realm of finance, diversifying your investment portfolio is a fundamental approach that is acknowledged for its capacity to reduce risk and perhaps increase profits. This ability has earned it widespread recognition. This idea derives from the fundamental tenet that diversifying one’s holdings across a variety of asset classes, sectors of the economy, and geographical locations may help mitigate the negative effects of gyrations in the market and slowdowns in the economy.

When you diversify your holdings, you lower the risk that comes with having a large portion of your capital invested in a single asset or industry. If you invest all of your money in a single stock, for instance, your financial well-being will become heavily dependent on the performance of that one particular firm. However, if you diversify your assets, you may offset losses in one area with profits in another, which may lead to a more stable and consistent total return on your investment. This can be accomplished by spreading out your investments.

Additionally, diversification can assist you in tapping into a wider variety of possibilities, potentially improving the likelihood of your locating assets that provide extraordinary returns and also boosting your overall returns. It is essential to keep in mind that diversity does not completely remove risk; nonetheless, it is a strong technique for managing and reducing risk while simultaneously setting your portfolio for the possibility of better returns that are more consistent over the long run.

Develop income streams that require minimal ongoing effort, such as online businesses!

The development of many revenue streams that call for only a little amount of continuing effort, such as the operation of an internet business, can be a game-changer in terms of gaining financial independence and flexibility. Once they are created, these passive income sources have the benefit of creating money with less day-to-day engagement. This enables you to earn while focusing on other elements of your life, which frees up time for you to pursue other opportunities.

The creation of original content, affiliate marketing, and e-commerce storefronts are all excellent examples of passive revenue streams that online businesses can produce. After you have established a profitable online enterprise and completed the necessary groundwork, you will be able to keep earning money from it even while you are not actively working on it. This might entail generating money from sales, advertisements, or commissions from affiliate programs without having to actively run the business.

It is essential to note, however, that the creation of a passive income stream typically necessitates substantial labour and devotion up front, in addition to perhaps requiring financial investment. The development of a strong foundation, the attraction of traffic or consumers, and the upkeep of high-quality content or items are all necessary components for long-term success.

These types of passive income can offer a number of benefits, including financial stability, the freedom to pursue other things with your time, and the possibility of a slow but steady increase in wealth. They have the potential to be an essential part of a diversified income portfolio, which may assist you in achieving your long-term monetary goals with less day-to-day engagement.

Enhance your skillset through education and training to increase your earning potential!

Continual education and training may be a smart investment in your future that can greatly increase your earning potential. If you enhance your skill set, this investment will pay off for you in the long run. To maintain one’s relevance and ability to compete in today’s employment market, one must make a commitment to ongoing education throughout their working life.

Acquiring new skills and information is essential, whether you want to make progress in your present profession, move into a different industry, or launch a brand-new business endeavor. If you want to make yourself a more desirable candidate for high-paying professions and prospects, getting some additional credentials, certifications, or advanced degrees can help.

In addition, the acquisition of new skills is not restricted to the realm of formal schooling. You may also contribute to your knowledge through self-study, workshops, seminars, and online courses. Maintain an awareness of the latest developments in the sector as well as any upcoming technology; doing so can help you position yourself for higher-paying employment.

In addition, having well-honed “soft skills” such as communication, leadership, and problem-solving can be just as beneficial in increasing your earning potential because these are the types of qualities that employers look for most frequently.

When it comes down to it, the more effort you put into enhancing your skill set, the better position you put yourself in for professional advancement, improved employment prospects, and the possibility of a larger salary, laying the groundwork for sustained monetary success.

Manage debt effectively by reducing high-interest debt to free up funds!

Managing debt effectively is a crucial component of achieving long-term financial growth and stability. High-interest debt, such as credit card balances or payday loans, can be a significant drain on your financial resources. To improve your financial standing, it’s essential to prioritize reducing and ultimately eliminating this kind of debt.

Start by creating a comprehensive list of your debts, including the outstanding balances, interest rates, and minimum payments. Develop a debt repayment plan that focuses on tackling high-interest debts first. You can free up money that was previously going toward interest payments by paying off these debts quickly.

Consider consolidating your high-interest debts with a lower-interest option, such as a personal loan or a balance transfer credit card, to reduce the overall interest you pay and make repayment more manageable.

Practice responsible spending habits to prevent accumulating more high-interest debt. Creating a budget, living within your means, and avoiding impulse purchases can help you maintain a debt-free future.

By managing your debt effectively and reducing high-interest obligations, you can redirect those funds towards savings, investments, or other income-generating opportunities, ultimately contributing to your long-term financial growth.

Multiple revenue streams in your current career!

You can increase your income and improve your long-term financial stability by investigating the possibility of generating money from several sources within the context of your existing line of work. Your earning potential may be increased even further by diversifying your revenue sources within your existing sector, in addition to growing in your chosen career, which is of course beneficial.

Consulting and Freelancing: Give some thought to providing your services as a consultant or freelancer in the industry that you work in. Because of this, you are able to take on additional assignments beyond your normal employment, which results in increased money.

Teaching and Training: Pass on your expertise to others by instructing courses, workshops, or seminars that are directly connected to your line of work. This not only increases the amount of money you make, but it also strengthens your reputation as an authority in your field.

Create a side business by working on projects or items that are connected to your main line of work. If you work in the technology sector, for instance, you can consider developing software applications or other software tools that bring in additional cash.

Mentoring and Coaching: If you have experience in either of these areas, you may like to consider mentoring or coaching junior colleagues or newcomers to your industry.

Earning a living as a writer or public speaker can be accomplished through publishing articles or books, or by delivering lectures at conventions in exchange for author royalties or speaker fees.

If you work in a field that allows for several income streams, you can not only improve your financial security but also advance your career by gaining useful experience and increasing your visibility within your field, which might lead to the opening of doors leading to more chances and professional development.

Regularly assess your income streams and make adjustments as needed to stay on track toward long-term financial growth!

You must make it a habit to evaluate and modify your many sources of income on a continuing basis if you want to maintain your trajectory toward sustainable long-term development and improvement in your financial situation. Because the economy is always changing and people’s lives are always changing, it is crucial to conduct frequent audits of your income sources and make any required modifications. Because the financial landscape is always changing, it is essential to do so. This is why it is so important:

Changes in the Economy: The economy is in a constant state of flux, which has a direct bearing on the ways in which investments, employment markets, and business prospects fare. Maintaining vigilance gives you the ability to respond effectively to changes in the environment.

Significant life changes, such as getting married, having children, or retiring, may require you to make modifications to your income streams so that they are more in line with your newly established financial objectives and obligations.

Trends in the Market: Industries or technologies may provide new prospects for generating money, but areas that are experiencing decline may force you to pivot.

Financial Objectives: When your objectives develop over time, you may find that you need to adjust the proportion of your attention that you devote to generating income. For example, when retirement draws nearer, you may want to switch from development plans that emphasize aggressive expansion to those that emphasize stability.

An assessment of your various sources of income can assist in the identification and mitigation of potential hazards, contributing to the maintenance of your financial stability.

Your ability to remain adaptive, grasp new opportunities, and handle problems efficiently may be cultivated by conducting routine evaluations and making appropriate modifications to your income plan. This will pave the way for a sustainable route towards long-term financial development and prosperity.

In Conclusion!

Diversifying one’s sources of income is an essential component of a successful plan for achieving long-term monetary expansion and stability. If you only have one source of income, you run the risk of suffering from unanticipated difficulties as well as changes in the economy. You can build a solid financial foundation for yourself by putting the tactics suggested in this guide into action. This foundation will not only protect your financial well-being, but it will also accelerate you toward the achievement of your financial objectives.

Important initial measures include doing an analysis of your existing financial situation, locating potential new sources of income, and improving your skill set. Increasing one’s financial stability may be accomplished through establishing many streams of passive income, diversifying their investment portfolio, and actively managing their debt.

Furthermore, investigating alternative revenue streams within your present profession and making regular tweaks to your income plan will keep you versatile and ready for development. Both of these things may be done within your current career. Keep in mind that attaining financial success requires not just devotion but also discipline and a focus on the long run. You may establish the financial security and prosperity you seek, assuring a better and more secure future, if you carefully pursue income diversification and remain proactive in managing your money. If you do this, you will be able to achieve the financial security and success you desire.