Automating fixed expenses and tracking spending are essential steps in achieving financial stability and maintaining a healthy budget. By automating fixed expenses like rent or mortgage payments, utility bills, and subscription services, you can ensure that these obligations are consistently met without manual intervention. This not only saves time but also minimizes the risk of late payments and associated fees.

Tracking your spending, on the other hand, allows you to gain a clear understanding of where your money goes. It empowers you to make informed decisions, cut unnecessary costs, and save more effectively. We will explore practical strategies and tools to streamline your fixed expenses through automation and implement efficient methods for monitoring your spending habits. By mastering these techniques, you’ll be better equipped to achieve your financial goals and build a more secure financial future.

| Table Of Contents |

| Configuring Your Account for Automatic Payments! |

| Software and Mobile Applications for Budgeting! |

| Understanding the Importance of Creating a Complete Budget! |

| If you want a thorough perspective on your financial habits, categorize both your fixed expenses and your discretionary spending! |

| Set up alerts and notifications so that you are kept informed about incoming bills and that you never miss a payment deadline! |

| Explore various methods for tracking your daily spending, from traditional methods like pen and paper to modern digital solutions! |

| Learning to analyze spending habits! |

| In Conclusion! |

Configuring Your Account for Automatic Payments!

Setting up your bank account to make payments automatically is a prudent financial step that may save you time, minimize the amount of stress you experience, and help you avoid incurring late penalties. To get you started, here is a step-by-step instruction to follow:

Determine Your Fixed Costs To start, make a list of all of your permanent expenses, such as payments for your rent or mortgage, utility bills, insurance premiums, and the repayment of any loans you may have. The first essential step is to have an understanding of what must be paid on a consistent basis.

Choose the Most Convenient Payment Option for Each Fixed Expense: Determine the payment method that will be most convenient for each fixed cost. Among these options are the use of credit or debit cards, the setting up of automated bank transfers, and the utilization of online payment systems made available by your service providers.

Check with each service provider to determine the payment plan that is compatible with your current level of financial stability. You have the choice of making payments on a monthly, quarterly, or annual basis, the majority of the time.

Establish Notifications: Establish notification systems for incoming payments through your bank or other financial institution. These notifications will warn you when a scheduled payment is due to be withdrawn from your account. This will help you keep informed and ensure that you have enough money in your account to cover the payment.

Retain Records: Be sure that you keep detailed records of all of your recurring payments, including the dates, amounts, and methods of payment. You will be able to check your account for any inconsistencies and maintain track of your financial responsibilities with the assistance of this record.

Fund for Emergencies: It is important to always keep some money set aside in the event that you incur unanticipated costs or experience a change in your current financial condition. This will ensure that your automated payments do not result in overdrafts or missed payments.

Your financial life will be simplified, and you’ll have greater control over your fixed spending if you set up your account so that automatic payments may be made from it. This will contribute to your financial stability and provide you with more mental ease.

Learn how to set up automatic payments for fixed costs such as your rent or mortgage, insurance premiums, and loan repayments so that you don’t have to worry about paying them on time manually. This will guarantee that your payments are always made on time.

Software and Mobile Applications for Budgeting!

Here, you will learn about popular budgeting software and mobile applications that may assist you in automating the tracking of your expenses and gaining insights into your spending habits. It takes the necessary tools to effectively manage your finances, and there is a wide variety of software as well as mobile applications available that are meant to make budgeting easier and more efficient.

The following are some well-liked choices:

Mint is a comprehensive and userfriendly budgeting program that links to your bank accounts, credit cards, and invoices. Mint helps you keep track of all your financial obligations in one place. It assigns predetermined labels to transactions, keeps tabs on how much money you spend, and offers analysis of the patterns in your financial behaviors.

YNAB, which stands for “You Need A Budget,” is a program for budgeting that focuses on assisting you in assigning a clear purpose to each dollar you spend. It promotes forward-thinking budgeting and provides educational materials to help you become more financially literate.

Personal Capital is an excellent choice for investors since it provides budgeting tools in addition to capabilities for managing investments and preparing for retirement. It gives you a comprehensive picture of your current financial status.

Pocket Guard is an application that makes budgeting easier by determining the amount of money left over for discretionary spending after taking into consideration recurring expenses and long-term savings objectives. It provides a straightforward balance for “In My Pocket.”

Good Budget is a digital implementation of the envelope budgeting system, which may appeal to some users. You may better keep track of your spending by allocating funds to distinct virtual envelopes that correspond to the various types of purchases you make.

Quicken has a comprehensive set of capabilities for both budgeting and financial planning. Desktop program that offers comprehensive analysis as well as tracking for investments, making it suited for use in scenarios involving complicated financial situations.

Wally is a costfree expense monitoring program that features a straightforward user interface. Wally enables you to keep track of your spending and establish targets for your savings. It is easy to use and is able to synchronize with your various bank accounts.

Dave Ramsey created a zero-based budgeting program called Every Dollar. It walks you through the process of creating a budget and ensures that every dollar spent has a specific function. Your tastes, the level of complexity of your financial situation, and the goals you have for your finances that will play a role in helping you choose the appropriate program or app. You may test out a lot of these programs for free before committing to one, so that you can choose the one that caters to your requirements the most effectively.

Understanding the Importance of Creating a Complete Budget!

Realize how important it is to create a complete budget that includes all of your fixed spending. This will make it much simpler for you to track and manage your financial commitments.

Developing a detailed spending plan and sticking to it is the first step in achieving your financial objectives and gaining financial stability. It is more than just keeping track of your expenditures; rather, it is a comprehensive strategy that guarantees each and every part of your financial life is taken into account. This is why it is so important:

Clarity on Your Financial Situation: A detailed budget will give you a concise summary of your income and spending. It reveals the origin of your money as well as the places it is spent, empowering you to make decisions based on accurate information.

Establishing Goals: Having a budget allows you to establish concrete targets for your own finances. A budget enables you to more effectively allocate finances toward the accomplishment of certain financial goals, such as saving for a trip, paying off debt, or creating an emergency fund.

In the absence of a budget, it is easy to go overboard with spending in a number of different categories. The act of creating one compels you to assign spending priorities, ensuring that you spend money on needs before spending it on non-essentials.

Management of Debt: Creating a budget allows you to approach debt in a more organized manner. It gives you the ability to direct additional dollars toward paying down debt, which might end up saving you money on interest payments.

Preparedness for Emergencies: Every budget should include a line item for covering unforeseen costs. Including contributions to an emergency savings account as part of your monthly budget helps to protect you from unexpected and unplanned expenses.

Investments and Savings: A percentage of your income is set aside in your budget for savings and investments, which will assist you in amassing money over time and give you peace of mind regarding your future finances.

Peace of Mind: Knowing that you have a strategy to minimize the amount of stress caused by finances. It guarantees that you are in charge of your financial situation, as opposed to being at the whim of your variable income and spending.

Developing a detailed budget is, in a nutshell, the first step in achieving your financial goals. As you work towards achieving your financial goals, it will offer you the necessary discipline, direction, and peace of mind.

If you want a thorough perspective on your financial habits, categorize both your fixed expenses and your discretionary spending!

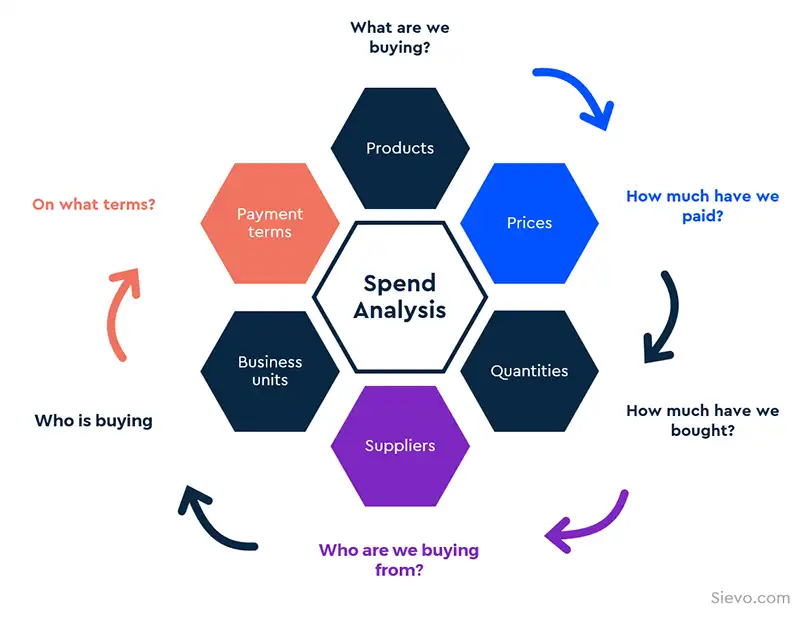

It is essential to classify both fixed costs and discretionary spending in order to have a complete picture of your current spending patterns when it comes to money. These categories provide different perspectives on your current financial situation:

Costs That Are Constant:

In the area known as “necessities,” you’ll find necessary fixed costs such as rent or mortgage payments, electricity bills, grocery bills, and premiums for insurance policies. It emphasizes the costs of life that are considered normal.

Repayments on loans such as school loans, auto loans, and credit card minimum payments are examples of fixed costs that fall under the category of debt obligations. This section exposes the financial obligations you have made and how you handle your debt.

Include your contributions to retirement accounts, savings accounts, and investment accounts under the category of fixed costs. This demonstrates your dedication to accumulating riches and ensuring a bright future for yourself.

Expenditures of Your Own Free Will: This category includes costs incurred for activities that are considered to be forms of recreation, such as going out to eat, going to the movies or concerts, or participating in hobbies. It indicates the amount of money you spend on various forms of leisure and relaxation.

Shopping: Keep track of the costs incurred while shopping for non-essential products such as apparel, electronics, and decorative items for the home. It demonstrates how you decide to distribute cash to make arbitrary purchases.

Spending your discretionary income on travel, such as vacations and weekend trips, might give others clues about your values and the way you choose to live your life. Consider using a miscellaneous category for costs that are hard to estimate or that occur on an irregular basis. This category acts as a catch-all for things that aren’t covered by any of the other categories.

You will have a better understanding of where your money is going if you separate your fixed costs from your discretionary spending. With this insight, you are able to create more accurate budgets, make more educated decisions, and modify your spending patterns so that they are more in line with the financial objectives and priorities that you have set for yourself. This will make it much simpler to find areas in which you might stand to make improvements.

Set up alerts and notifications so that you are kept informed about incoming bills and that you never miss a payment deadline!

This will ensure that you never miss a payment deadline. Setting up alerts and notifications for arriving bills is a sensible financial habit that may help you keep organized, avoid late penalties, and maintain a healthy credit history. Setting up alerts and notifications for incoming bills can be done by setting up alerts and notifications for incoming bills. You can make sure that you are constantly notified and that you never miss a payment deadline by following these steps:

Create reminders for payment deadlines for upcoming bills using your electronic calendar or a task management app with calendar alerts. You should schedule these reminders a few days in advance to ensure that you have sufficient time to make payments.

Notifications Via Email: A large number of service providers and banks send notifications via email for future invoices. Make sure this function is turned on for all of your recurring costs, and check your email frequently for any updates.

Applications for Mobile Devices Download: the applications for mobile devices that are offered by your service providers or financial institutions. The majority of the time, these applications will deliver push notifications about future invoices, enabling you to take prompt action.

A number of businesses now provide customers with the option of receiving bill payment reminders in the form of text messages. You can have timely notifications delivered to your phone if you sign up for this service.

If your financial institution provides services for the automatic payment of bills, you should seriously consider registering with them. By setting up automated bill payment on the due date, the possibility of late or missed payments is significantly decreased.

Alerts for Online Banking: You may set up alerts for your online banking account to tell you when certain events occur, such as when invoices are due or when a major transaction takes place.

Bill Pay Services: Make use of the bill pay services offered by your financial institution. These services typically include the option to be notified of impending payments through email or text message.

You can make sure that you are constantly informed of upcoming bills and the dates on which they are due by setting up these alerts and notifications and putting them to use. Taking this preventative measure can assist you in more efficiently managing your money, preserving a healthy credit score, and avoiding the stress of late payments and the fines that are connected with them.

Explore various methods for tracking your daily spending, from traditional methods like pen and paper to modern digital solutions!

Keeping tabs on your day-to-day expenditures is an essential component of good financial management. You may maintain control of your spending through the use of a variety of strategies, some of which are more conventional while others are more contemporary.

The traditional technique entails keeping a physical ledger or notebook to record every expense. This can be done with a pencil and paper. It makes it possible to get a clear picture of how your money is being spent.

The envelope system involves allocating funds for various expenditure categories into envelopes that are then labeled. When all of the money in a certain category has been spent, you will no longer have that option.

Excel and Spreadsheets: Make a digital spreadsheet to record and organize your expenditures, and use Excel or Spreadsheets. Calculations and analyses of data are facilitated as a result of this.

When linked to your bank accounts and credit cards, several budgeting applications for mobile devices, such as Mint, YNAB, or PocketGuard, automatically track and classify your spending as you make purchases.

Receipt Scanning: Some applications provide you with the ability to scan and digitally save receipts, which makes it much simpler to monitor and organize spending while you are on the move.

Alerts from Your Bank You can receive notices from your bank anytime your card is used if you set up transaction alerts with them. This will allow you to keep an eye on your spending in real time.

Accounts from Credit Cards You should routinely study your credit card accounts, as these documents frequently organize your spending in distinct categories. The websites of several credit card firms provide users with comprehensive expenditure breakdowns.

Software for Tracking Expenses Having dedicated expenditure tracking software, such as Expensify or QuickBooks, simplifies the process for firms and individuals who are self-employed.

Pick a technique of tracking that fits in with your tastes and the way you live your life. When you combine digital solutions with conventional techniques, you may get a more complete picture of your spending patterns, which can help you make more educated decisions about your finances.

Learning to analyze spending habits!

One of the most important things you can do to become more financially conscious and improve your situation is to do a review of your typical spending patterns. The following is a strategy that will assist you in efficiently analyzing your spending:

Gather Your Information Collect all of your financial documents, such as bank statements, credit card statements, and receipts, and put them in one place. Make certain that you have an exhaustive record of all of your expenditures.

Organize Your Expenses by Categorizing The process of organizing your expenses by grouping them into categories such as groceries, utilities, transportation, dining out, and entertainment can help you save money. This classification gives you a clear breakdown of where your money is going so you can better manage it.

Determine Trends: Analyze how your expenditures have changed over the course of time. Exist recurrent patterns, such as the seasonal ups and downs or the monthly peaks and valleys that specific categories experience?

Budget versus Actual: Contrast your actual expenditure with the spending you had planned for. Determine the areas in which you are either spending too much or not enough money. This gives you a better idea of whether or not your budget is feasible.

Keep tabs on your variable and fixed expenditures: Make a distinction between costs that are fixed, such as rent and utilities, and those that are up to your discretion, such as dining out or entertainment. This helps prioritize the spending that is essential.

Evaluate Necessities Determine whether or not you are able to cut expenditures in areas that are considered necessities, such as groceries or utilities. Try to find less expensive alternatives or special deals if you can.

Reduce Unnecessary Costs: Determine which costs are not needed and may be cut back on or eliminated entirely. Put those cash toward savings or the repayment of your debts instead.

Establish objectives: In order to establish concrete monetary objectives, you need first do an analysis of your expenditures. It is important to make sure that your budget is in line with your goals, whether you are trying to establish an emergency fund, pay off debt, or save money for a trip.

Review on a Regular Basis: Make it a practice to evaluate your expenditures on a regular basis, such as once every month or once every three months. This guarantees that you keep to the plan and swiftly alter anything that has to be changed.

You are able to acquire useful insights into your financial behavior, which enables you to make decisions that are in your best interest, reach your financial objectives, and build a better financial future by continuously monitoring your spending patterns.

Finding out how to make the required modifications to your fixed costs and discretionary spending based on your budget analysis is the first step in adjusting and optimizing your spending so that you may finally work toward achieving your financial objectives and increasing your savings.

In Conclusion!

Accomplishing financial mastery is a path that calls for unwavering commitment and consistent work. Keep in mind that your level of financial well-being is not just dependent on how much money you earn but also on how effectively you handle and distribute the resources at your disposal. Make a spending plan, keep careful track of your outgoing money, and sort it into appropriate buckets to get a complete picture of your financial behaviors.

Review your spending habits on a regular basis and make any necessary adjustments to your budget in order to bring it in line with your objectives. Putting money away and making wise investments should be your top priorities. The path to establishing financial stability should begin with the establishment of an emergency fund and should continue with the reduction of debt. Having a solid understanding of finances is a really significant asset. Always be on the lookout for new information on personal finance, investments, and economic trends in order to make judgments that are well-informed.

Patience and discipline will be your best partners on the path to achieving your financial goals. Today’s modest efforts, if maintained over time, can pave the way to great financial independence tomorrow. Hence, maintain your dedication, remain flexible in the face of shifting conditions, and keep in mind that achieving monetary success is within your grasp if you cultivate the appropriate mentality and behaviors.