Adopting money management practices that encourage frugality is a potent strategy for seizing control of one’s financial future. In a society that is frequently characterized by unrelenting materialism and unstable financial conditions, cultivating a mindset of frugality can help pave the way to financial independence and security. This shift in viewpoint encourages conscious spending, savings, and investment choices that favour long-term financial goals above short-term pleasures. These choices can have a significant impact on one’s financial future. Understanding the significance of frugality is the first step on the path to achieving your financial goals, whether those goals are to create an emergency fund, eliminate debt, or attain financial independence. We will look into the potentially life-altering effects of frugal money habits as well as the actionable measures that may be taken to incorporate them into your daily routine.

| In Conclusion |

| Putting a Definition on Frugality! |

| The Benefits of Frugal Living! |

| The Role of Frugality in Goal Achievement! |

| Avoid Extremes in Frugality! |

| Enjoying Life While Being Frugal! |

| The Connection Between Frugality and Sustainability! |

| Join Frugal Living Communities! |

| Cultivating a Long-Term Frugal Mindset! |

| In Conclusion! |

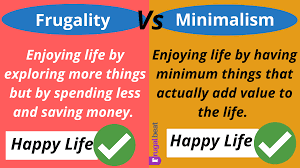

Putting a Definition on Frugality!

The beacon of financial wisdom known as frugality is not simply the act of saving pennies; rather, it is an intentional and conscientious choice to make the best use of available resources. The skill is in being able to differentiate between necessities and desires, rethinking one’s priorities, and embracing a more straightforward lifestyle. Individuals can create a road to financial independence and freedom by practicing frugality, since it enables them to live below their means. It is a dedication to frugal spending, ingenuity, and the pursuit of value that will stand the test of time. Frugality, in its purest form, is the key to unlocking a life free from the weight of debt, in which every dollar saved brings one step closer to the realization of aspirations and the guarantee of a happy future.

The Benefits of Frugal Living!

A frugal way of life can result in a wealth of positive outcomes. It does this by putting a lid on wasteful expenditure, which in turn makes room for increased levels of savings to develop. Due to the realistic goal of debt reduction, financial pressures are less stressful. The practice of frugality cultivates ingenuity and inventiveness, leading to the discovery of pleasure in reusing and reducing waste. It encourages environmentally responsible behaviour by creating a sustainable way of living. It instils discipline and patience, both of which are vital attributes for sustained monetary success. Frugal living encourages individuals to connect their spending with their principles, which ultimately results in a life that is more satisfying and purpose-driven since the individual is able to put their necessities ahead of their wants. It’s a technique to achieve financial independence, which in turn opens the door to freedom and mental tranquility.

The Role of Frugality in Goal Achievement!

One of the most important factors that helps people make progress toward their objectives is frugal living. Individuals are able to more precisely manage resources when they take on a thrifty mentality, which helps to ensure that each and every dollar is put to good use. This methodical technique not only speeds up the process of saving money but also reduces the amount of money that is frivolously spent, which in turn speeds up the process of achieving one’s financial goals. It is therefore possible to reduce debt, which frees up cash for investment and increases the potential for wealth generation. The cultivation of patience and resiliency through thriftiness is an important step in achieving one’s goals. It gives credence to the idea that making small sacrifices now might result in significant gains in the future. The practice of frugality, in its most fundamental form, serves as the cornerstone for converting ambitions into reality, presenting a clear road to the attainment of both short-term and long-term goals.

Avoid Extremes in Frugality!

Although practicing thriftiness is something to be commended, it is essential to steer clear of taking it to extremes. Extreme thriftiness can lead to a decline in one’s quality of life as well as strain on one’s personal connections. Finding a happy medium is crucial, and it is necessary to make a distinction between expenditures that are necessary and those that are not. It’s not always in one’s best interest to deprive themselves of life’s simpler pleasures. In addition, saving money should never be at the expense of one’s health, safety, or overall well-being. Even if it means spending money, one should put their money towards things like education, health, and personal development. The adoption of a frugal lifestyle should enrich one’s life rather than place unnecessary limitations on it. Individuals are able to reap the benefits of frugality while also enjoying a lifestyle that is both enjoyable and sustainable if they avoid extremes.

Enjoying Life While Being Frugal!

Adopting a frugal lifestyle does not imply giving up on having fun; on the contrary, it may actually make life’s joys more enjoyable. It promotes innovative and frugal methods to enjoy the precious moments that life has to offer. It’s possible to get just as much enjoyment out of staying in and cooking a meal for yourself or checking out some free events in your community. The practice of frugality encourages mindfulness, which in turn cultivates a greater appreciation for life’s straightforward joys. Setting aside a reasonable sum of money each month for recreational activities ensures a balanced approach. Individuals who practice frugality are better equipped to reallocate the income they save by avoiding unnecessary expenditures to pursue their long-term goals and interests. Finding happiness in the process, creating an attitude of appreciation, and focusing one’s attention on those activities and events that are actually meaningful are the ultimate keys to living a fulfilling life on a budget. It’s a route to a life that’s not just more fulfilling but also more secure financially.

The Connection Between Frugality and Sustainability!

There is a strong relationship between frugal living and sustainable practices that extends beyond the fields of finance and the environment. Living frugally will naturally result in less consumption, which will in turn result in less waste and a smaller carbon impact. It encourages environmentally responsible behaviors such as recycling, upcycling, and energy efficiency. Frugality, which prioritizes quality over quantity, supports the adoption of long-lasting, environmentally friendly items. Practicing thriftiness is frequently associated with leading a simpler lifestyle, which helps to cultivate a stronger connection with the natural world and the environment. Gardening and cutting down on the use of single-use products are two examples of sustainable activities that go hand in hand with frugality. Frugality is a formidable force in establishing a sustainable and environmentally friendly future because of its symbiotic relationship with the earth, which not only helps the world but also adds to the long-term financial well-being of individuals.

Join Frugal Living Communities!

The key to maintaining sound financial health over the long run is to develop an attitude of thriftiness. It requires rethinking your relationship with money, giving your necessities more priority than your wants, and becoming comfortable with delaying satisfaction. To get started, write out some specific monetary objectives and keep careful track of your progress. Establishing sound financial practices, such as sticking to a budget and putting money away regularly, should eventually become automatic for you. Over time, make it a priority to build up your financial fortitude by establishing an emergency fund and paying off your debt. Maintain a constant commitment to your own education in the areas of personal finance and investing. Put yourself in a position to succeed by surrounding yourself with a network of people who have the same ideals of frugality as you do. On the other hand, an attitude of long-term frugality is not a passing fad but rather a commitment to long-term financial independence and stability.

Cultivating a Long-Term Frugal Mindset!

Making prudent financial decisions that are able to withstand the test of time is essential to developing a mentality of long-term frugality. The first step is to define your objectives in a way that is both specific and attainable, and then to develop and maintain regular behaviors that save money, such as creating a budget and setting up an automated savings plan. Recognize that practicing frugal living is a marathon, not a sprint; having patience and resiliency are both essential. Learn to embrace change and adapt to the various experiences life throws at you by continually expanding your financial knowledge. To keep yourself motivated and accountable, surround yourself with a group of supportive people or find a mentor. Understand that a frugal mentality is not just about accumulation but also about intentional spending that matches your beliefs, which will ensure long-term financial security and a life path that is enjoyable. This is the most crucial part of developing a frugal mindset.

In Conclusion!

Adopting more conservative spending patterns is a transforming process that ultimately results in more financial autonomy and safety. The practice of frugality does not include deprivation but rather the deliberate decision to place importance on that which is most important, refrain from spending money unnecessarily, and work toward achieving meaningful financial objectives. Individuals are able to take charge of their own financial futures if they get an appreciation for the benefits of thriftiness, articulate their goals with precision, and implement financially astute behaviors. Keep in mind that striking a healthy balance is crucial and that it is possible to enjoy one’s life while maintaining a thrifty lifestyle. Frugality, in the end, is a commitment that one makes over their whole life that not only results in the accumulation of money but also promotes sustainability, resilience, and a profound feeling of fulfillment on the way to achieving financial well-being.