Self-made millionaires are excellent examples of the art of achieving monetary success, which is a path that is built with prudent choices and unyielding discipline. However, what distinguishes them from others is their unwavering dedication to economically responsible behavior. They continue to follow these routines even after becoming millionaires because they are the foundation of their financial success. They are aware of the long-term benefits of conserving money, making intelligent investments, and living within their means. The practice of frugality does not include deprivation; rather, it emphasizes making deliberate decisions, practicing delayed gratification, and protecting one’s financial future. The fact that these self-made millionaires continue to draw inspiration from their humble origins demonstrates that frugality is still a crucial component of long-term financial success, despite the fact that the contemporary period places a premium on luxurious living.

| Table Of Contents |

| Frugality as a foundation for wealth-building |

| How does frugality differ from cheapness? |

| Achieving financial freedom through frugality |

| The power of saying ‘no’ to instant gratification |

| Passing on frugal values to the next generation |

| Educating children about money management |

| Encouraging financial literacy |

| The link between frugality and personal growth |

| Invest in self-education and skill development |

| Evolving with changing financial landscapes |

| In Conclusion |

Frugality as a foundation for wealth-building!

Frugality is undeniably the bedrock upon which wealth-building thrives. By consciously embracing a frugal lifestyle, individuals can allocate their resources more efficiently. This entails prudent spending, eliminating wastefulness, and saving diligently. The surplus funds accumulated through frugality can then be channeled into investments that grow over time, thanks to the magic of compound interest.

Frugal individuals prioritize their financial future over fleeting indulgences, creating a solid foundation for economic security. In essence, frugality isn’t merely about penny-pinching; it’s a strategic approach that empowers individuals to construct a path towards financial prosperity, ultimately realizing their dreams and ambitions.

How does frugality differ from cheapness?

Although frugality and cheapness share certain similarities, the concepts that guide each of these approaches couldn’t be more different. When it comes to managing one’s finances, frugality is a methodical and astute strategy that focuses on getting the most out of one’s money while maintaining quality and long-term objectives. Individuals who practice frugality are those who make deliberate decisions to cut expenses without jeopardizing their health or the health of others around them.

On the other hand, cheapness is a mindset that is shortsighted and frequently self-centered. It is exclusively obsessed with lowering expenses at any cost, which can result in substandard products or services. It frequently ignores the more comprehensive financial picture, which can have a detrimental effect on relationships as well as personal pleasure. Cheapness, on the other hand, refers to the aimless pursuit of the lowest price, which frequently comes at the expense of overall quality and value. Frugality, on the other hand, is all about making well-informed decisions.

Achieving financial freedom through frugality!

The public is currently talking a lot about the trend toward living frugally, especially in light of rising prices for goods like clothing, technology, cars, and basic necessities like houses. It is believed that a frugal lifestyle can be an alternative solution amidst these conditions, especially to achieve the financial goals of people who do it.

The achievement of financial independence is a target that many people have set for themselves, and one of the most effective ways to get there is to practice thriftiness. Individuals that adopt a thrifty way of life make it a point to cut back on spending that isn’t essential, place an emphasis on conserving money, and make investments that are financially responsible. Because of their methodical approach, they have been able to gradually amass riches and establish a solid foundation for their financial security.

As their savings accumulate, people gain greater influence over their financial destiny and become less reliant on the money they receive from their work and from external sources of finance. Practicing frugal living gives people the ability to acquire the freedom to pursue their ambitions, to make decisions based on their passions rather than on what is required of them, and to appreciate the mental freedom that comes with being financially independent.

The power of saying ‘no’ to instant gratification!

The capacity to resist the pull of instant satisfaction is a defining characteristic of both self-discipline and sound financial management. It requires putting off short-term gratification in favour of more substantial accomplishments. Individuals are able to direct their resources toward savings and investments if they forego short-term pleasures or avoid spending money on needless things.

This strategy makes use of the power of delayed gratification, which, over the course of time, results in increased financial stability and the creation of wealth. It is a demonstration of one’s dedication to a better future and an essential ability in the process of constructing monetary resiliency. Individuals may open the door to a more secure and prosperous financial existence, one in which their hopes and aspirations can be realized on a bigger and more long-lasting scale, just by exercising self-control and refusing to give in to transient pleasures.

An example of delayed gratification:

Delaying gratification is hard. Most people fail to achieve their goals because they choose immediate pleasure over pain.

Instant gratification is easy and enjoyable in the short term but has no long-term rewards.

Delayed gratification is hard in the short term but has a powerful long-term impact.

Before doing anything, check if it has short-term enjoyment or a long-term impact.

Passing on frugal values to the next generation!

A valuable legacy would be one in which one taught thrifty principles to future generations. It entails developing in children a sense of fiscal responsibility, teaching them how to make good purchases, and emphasizing the significance of saving money. Parents may teach their children the enduring advantages of frugality by having open communication with them and leading by example. This will give their children the ability to make educated financial decisions in the future.

The younger generation learns how to negotiate economic obstacles, avoid debt traps, and construct a financially secure future by cultivating these principles. In the end, this knowledge becomes a gift that goes on giving, helping to create financial independence, resilience, and a legacy of responsible money management that may be passed down through the generations.

Educate children about money management!

Teaching young people how to properly handle money is an important life skill that lays the groundwork for achieving and maintaining monetary security. It involves conveying to children the significance of working hard, putting money aside, and managing their finances responsibly. Parents and teachers may give children the ability to make educated decisions about their money by teaching them financial concepts such as budgeting, saving for goals, and differentiating between necessities and wants.

These early teachings cultivate a feeling of responsibility and financial literacy in children, which helps them negotiate the intricacies of managing their finances as adults. It encourages an attitude of autonomy and self-sufficiency, which makes it more likely that the next generation will be well-equipped to face monetary obstacles and ensure a stable financial future for themselves.

Talk About the Importance of Saving Money

- Help your child understand the value of saving money by teaching that money can be spent, shared, or saved. If you focus on the savings aspect first, the spending and sharing concepts come a lot easier.

- Explain what a savings goal is to help your child understand the purpose of saving.

- Help your child create a savings goal and identify a specific purchase for which to save. Start small with a short-term saving goal that will take a week or two. It can be a toy or treat, an item, or a service.

- If your child is very young, ask questions and provide ideas to help them make a decision about what to spend their money on. Guide the child through the process through careful planning and consistency.

- After mastering saving for a short-term goal, move on to a longer-term saving goal that requires a month or more of savings.

Encouraging financial literacy!

In the face of an ever more complicated economic world, the promotion of financial literacy is of the utmost importance. It entails cultivating an all-encompassing comprehension of monetary ideas as well as budgeting, investing, and the management of existing debt. Individuals are able to acquire the information and skills necessary to make educated judgments about money if they place a high priority on financial education.

They will be able to negotiate common financial issues and plan for long-term objectives such as retirement and homeownership as a result of having this level of financial literacy. It protects individuals from exploitative financial practices and guarantees more equal access to economic possibilities. Individuals who are financially educated are better prepared to develop wealth, safeguard their possessions, and contribute to a society that is more financially knowledgeable and stable.

The link between frugality and personal growth!

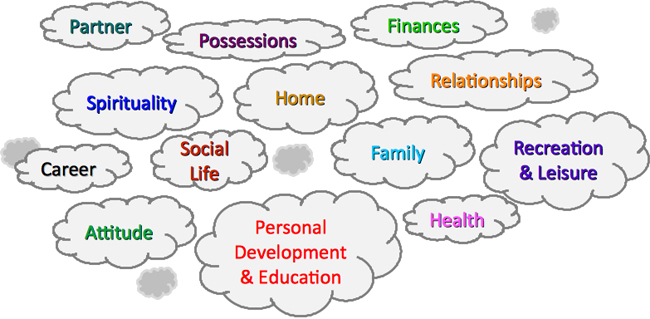

There is a strong correlation between modest living and one’s own personal development. The cultivation of self-awareness, self-discipline, and resiliency are all vital components of human growth, and frugality helps promote these qualities. People develop a sense of purpose and the ability to make decisions based on their beliefs when they learn to prioritize the things in their lives that are actually important to them through the process of practicing frugality.

It cultivates a growth mentality, which enables individuals to accept difficulties, adjust to change, and develop key life skills like financial management and long-term planning. Frugality, when practiced over time, not only improves an individual’s financial well-being but also adds to their entire personal growth, ultimately resulting in a life that is more satisfying and purpose-driven, based on the foundations of mindful living and conscious consumerism.

Invest in self-education and skill development!

Putting time and effort into one’s own education and the acquisition of new skills is an essential component of any successful plan for professional or personal advancement. It takes making a deliberate decision to devote oneself to learning new things and improving one’s practical abilities. An individual’s level of competence, flexibility, and employability all improve when they commit time and resources to their own personal development.

Learning new things on a consistent basis broadens their perspectives, which in turn encourages innovation and improves their ability to solve problems. It may result in higher earning possibilities as well as professional progression opportunities. Self-education gives people the capacity to keep up with the continuously changing sectors in which they work. This investment not only benefits them in their professional lives, but it also enhances their personal growth, which in turn boosts their confidence and broadens their viewpoint, which finally results in a life that is more satisfying and successful.

Evolving with changing financial landscapes!

In today’s fast-paced world, it is essential to maintain a level of financial success by continuously adapting to shifting economic conditions. It requires being able to adapt to changing circumstances while also remaining knowledgeable about developments in the economy, investments, and financial technology. Individuals have the ability to capitalize on opportunities and reduce risk when they are open to change and proactively adapt their tactics.

This ability to adapt is especially important in this day and age of rapidly advancing technology and fluctuating economic conditions. It is crucial to keep abreast of developing trends, such as cryptocurrency and digital banking, in order to prepare for the future. Individuals who are able to keep up with the changes in the financial landscape are better able to protect their wealth and make the most of emerging possibilities; therefore, it is essential for them to maintain a level of flexibility as well as a desire to learn and adapt.

In Conclusion!

It is necessary to take efforts toward achieving long-term financial stability and a sense of personal fulfillment, such as adopting a modest attitude and implementing wise financial practices. Self-made millionaires are aware of the significant role that frugality plays in the process of their wealth accumulation. These individuals realize the necessity of living within their means, conserving money, and investing it properly. Individuals who are able to resist the temptation of quick enjoyment have the capacity to prudently distribute their resources and establish a foundation for future economic success. Instilling these thrifty ideals in the next generation helps to cultivate a legacy of responsible financial management and a healthy lifestyle. Individuals may ensure that they stay financially resilient and continue to make progress toward their financial objectives by making financial literacy a priority and investing in self-education. This allows individuals to adapt to changing financial landscapes, which ensures that they remain financially robust.

Over to you!

What about you? Do you plan on living a happier life this year? What are your ways of living frugal? Share in the comments.