There are many incredible benefits to being self-employed. For some folks, it’s the convenience of being able to work whenever and wherever they want. For others, it’s the ability to focus on work that they’re passionate about, pursuing their dreams and ambitions. And yet, for some, it’s simply the joy of having the final say in all business decisions. Yet, this provides an incredible opportunity. Similar to running your business, you have the ability to shape, define, refine, and actualize your own retirement goals. You don’t have to rely on someone else, invest in confusing retirement plans, or deal with HR when it’s time to finally retire. In other words, retirement is in your hands, and while that might make it seem stressful, it’s actually an exciting opportunity to make the most of it.

Here are 5 tips for self-employed retirement.

The growth of the gig economy has meant that a lot more people than ever before are now essentially their own bosses. Some are starting businesses; others have escaped the businesses and headed into freelancing.

There are many advantages to this lifestyle. But it also means no one else is looking out for you when it comes to retirement savings. Unlike employees with access to various retirement plans offered by their employers, it’s all up to you if you want to set money aside for your golden years.

As getting your retirement savings plan started as early as possible is always the best course of action, whether you are self-employed or not, the best time to start thinking about how you are going to fund your retirement is now, no matter how old you are.

To help you get started, here are five ‘tips’ to keep in mind as you begin to plan.

The benefits of diversity apply to you too.

Unless you manage them very carefully, the things that make you such a success as a self-employed person—your innovative thinking, your willingness to take risks, and your above-average optimism—can prove a disaster when planning for retirement.

The keys to long-term retirement investment success are solid advice, common sense, and a diversified portfolio, and they apply as much to you as they do to someone following a more traditional career path.

Don’t Sink Every Penny Into Your Business

Reinvesting profits in your business is a good idea, especially as the tax benefits can be rather appealing. Perhaps you have convinced yourself that as you get older, that investment will mean that you can sell your business for a hefty profit and ride off into the sunset with that, maybe even earlier than expected.

Sadly, the statistics don’t back up that idea. Numerous studies have shown that a mere 20–25% of privately owned small businesses are ever sold. There are a few reasons for this. One is that the success of a small business is often down to its owner’s own skills and network, and without them, it would not survive.

The second is that in today’s rapidly changing world and business environment, what is working today may become obsolete in the future, and maybe sooner than you think.

Unless you’re many steps ahead of technology and changing consumer attitudes and you employ people who are as good as you are, you have to accept at least the possibility that your small business may never sell. Having accepted that, start planning to fund a sound – plan that is completely separate from your business retirement plan.

Take Care of Your Current Self First

There’s little point in planning for retirement if you don’t make it that far. You need to ensure that, as a self-employed person who only has themselves to rely on to do such things, you have a good medical aid scheme in place, gap cover to make up the difference between what your medical scheme pays out and the actual cost of care, and sufficient life cover.

These things are all more affordable than you might think and should be firmly in place before you move on to the next step.

Have a Real Plan

You need a formal plan when it comes to preparing for retirement. Take an afternoon off and start researching your options by meeting with a financial planner. As a self-employed person, you are probably used to doing things alone and doing your own research. But unless you are in the finance business, there’s a lot you should know about successful retirement planning that simple Google searches can’t reliably teach you.

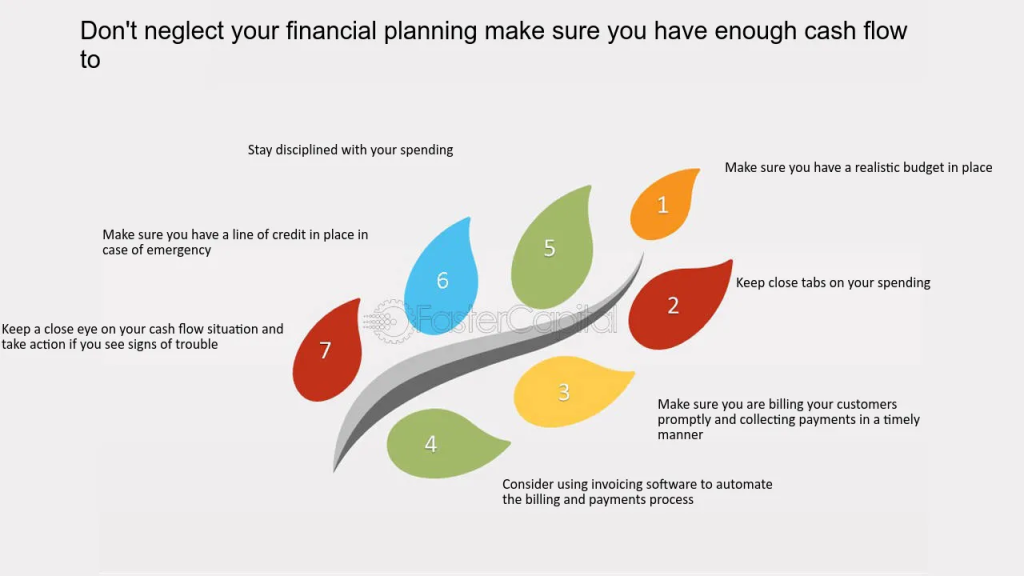

Don’t Neglect Your Business

Despite what we said earlier, don’t make the mistake of not giving your business the attention it deserves.Your business is your financial foundation; don’t disregard it. Business requires constant focus on development and profit. Regularly examine your business plan, reacting to market changes and developing trends. Since loyal customers help you succeed, prioritize customer happiness and retention. Keep up with industry changes and stay competitive by investing in professional development. Optimize resource allocation for company benefit. Innovation keeps products and services relevant in a changing market. By maintaining your business, you protect your finances and lay the groundwork for success. Remember, business health is directly related to retirement plan performance and overall success in general.

A defined benefit plan

There are also defined benefit plans available to those who are self-employed.These retirement plans promise to pay a specific amount each month or year over your lifetime once you retire.

Defined benefit plans are ideal for individuals with a large income who want to make higher retirement contributions. The contribution limit is determined based on the benefit you will receive in retirement, your current age, and the expected investment earnings.

Contributions to a defined benefits plan are usually deductible, and withdrawals in retirement are considered income for tax purposes. When establishing this type of plan, you must work with an actuary to calculate the deduction limit.

So that raises the question:

How Can You Save for Retirement?

The first step is to know how much you want to save. Remember, SMART (specific, measurable, achievable, relevant, and time-bound) goals are the cornerstone of every financial endeavor. Without setting a SMART goal, you’ll be saving for retirement without a plan.

Most financial advisors and institutions, including Fidelity, recommend an age-based calculation. By the time you retire, which will be at age 67, you should have 10 times your current income saved.

Of course, neither of these are “rules” you have to follow. You still have to think about your own unique lifestyle needs and personal circumstances. Your final goal will differ, but these might provide some guideposts on where to begin.

To get there, here are some retirement savings ideas to consider:

- Consider saving 15% of your yearly income for retirement. The earlier you start saving, the better. This is because compound interest and time will work in your favor. Conversely, the later you start, the more you’ll have to save to “make up for lost time.” This 15% figure is based on saving beginning at age 25.

- Consider building it into your budget or automating your savings. For many people, saving for retirement is an afterthought. By incorporating it into your budget and automating your savings, you are “paying yourself first.” Your future is as much of a priority as your bills and current cost of living.

- Consider starting immediately (if you haven’t already). Again, earlier is better, but it’s never too late to start. Yes, late is better than never. Don’t let negative thoughts or shame prevent you from saving for your future. Everyone has made financial mistakes in the past, but it’s how you move forward that matters.

- Consider reigning in your spending. Every rand or dollar you save can be applied towards debt, emergency savings, or your retirement account! While a few extra rands or dollars saved here and there might not seem like a lot, it adds up quickly. When combined with compound interest, the difference can be incredible over the course of several years and decades.

- Consider your emergency savings. One of the biggest mistakes you can make is to withdraw from your retirement savings. Not only would it be defeating the purpose of a retirement account, but you’ll be hit with hefty penalties and taxes for withdrawing early. Rather, it’s important to have a separate savings account specifically for your emergency fund. This way, when you need a new tyre, have a dental emergency, or need extra money to help cover the bills, you’ll be able to withdraw the money penalty-free.

Considering these tips, you’ll be able to make the most of your retirement plan as a self employed individual!

What Self-Employment Retirement Plans Are Available?

In a traditional job, your employer will sponsor a retirement plan that you can participate in and take advantage of.

Being self-employed, however, means that you’ll be responsible for shopping around for the best provider (broker) for your retirement accounts.

You can even contact your bank to see if they offer brokerage services.

In Conclusion!

Self-employed people need strategic preparation and disciplined financial practices to retire comfortably. To maximize compounding, making monthly contributions to retirement accounts. Second, diversify assets to reduce risk and boost growth. Maximize your savings by learning about self-employed tax breaks and credits. Consider creating an emergency fund to handle financial emergencies without jeopardizing your retirement aspirations. Finally, review your retirement plan to fit changing circumstances and maintain financial stability. Self-employed people can retire comfortably by following these guidelines.