Individuals have the ability to live financially responsible and sustainable lifestyles when they have mastered the skills necessary to live frugally. These fundamental abilities include creating a budget, being frugal, and conserving money, and they provide people with the ability to handle their financial situation in a responsible manner. Both minimalism and resourcefulness cultivate a mindset that emphasizes making the most of what one has, cutting down on waste, and leading a life that is more purposeful. The cultivation of the ability to rely on oneself for different requirements, such as providing oneself with food and making necessary repairs, is an essential component of self-sufficiency. This idea is expanded through sustainability to include the protection of the natural world by encouraging behaviors such as recycling and energy efficiency. Not only may you save money by completing do-it-yourself chores like gardening, cooking, and crafts, but you can also become more independent. Food waste may be reduced by making meal plans and using storage methods that are effective. Trading and bartering are both beneficial to society, as is the exchange of resources. A sense of financial security, personal fulfillment, and environmental responsibility can ultimately develop through mastery of these abilities.

| Table Of Contents |

| Identify areas where you can cut costs and prioritize saving and debt repayment! |

| Understand the importance of budgeting and track your expenses diligently! |

| Embrace mindful shopping! |

| Avoid impulse purchases and stick to your shopping list! |

| Cook at home more often and embrace affordable, nutritious ingredients! |

| Plan meals in advance and reduce food waste by using leftovers! |

| Optimize your vehicle usage by using public transportation or carpooling! |

| Build an emergency fund and save for retirement as well as future goals! |

| In Conclusion! |

Identify areas where you can cut costs and prioritize saving and debt repayment!

Steps that are essential to take in the direction of obtaining financial stability and security include locating expense-cutting opportunities and giving equal weight to conserving money and paying off debt. To get started, take a thorough look at your monthly costs and make a distinction between spending on essentials and spending on things you want. Common methods for saving money include limiting the number of times you eat out, cutting back on the number of subscription services you use, and searching for insurance policies that are less expensive.

As soon as you’ve identified these areas, put some of the money you’ve saved toward establishing an emergency savings fund. You won’t need to take on additional high-interest loans if you have this cash cushion to help you get through unforeseen costs. At the same time, put a percentage of your income toward the repayment of your obligations, prioritizing the payback of high-interest loans such as credit card balances.

Discipline and a thoughtful strategy are required in order to make paying off debt and saving money a top priority. You may help yourself remain on track by establishing concrete financial objectives and developing a spending plan. You may assure consistency in your savings and debt repayment by setting up automatic contributions to these accounts. Over time, you will not only be able to minimize the burden of debt, but you will also be able to construct a financial safety net, which will ultimately provide you with more financial independence and peace of mind.

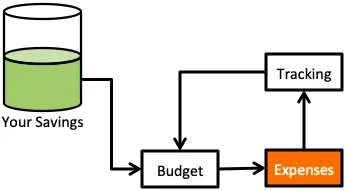

Understand the importance of budgeting and track your expenses diligently!

Achieving financial stability and accomplishing your financial objectives requires taking a number of essential measures, the most fundamental of which are having an understanding of the significance of budgeting and meticulously tracking one’s spending. A budget acts as a road map for your money, enabling you to more efficiently spend your income, plan for future costs, and make educated decisions regarding your finances.

When you make a budget and stick to it, you have a better idea of where your money is going and are better able to pinpoint areas in which you may reduce expenses or reallocate cash to give savings and paying off debts a higher priority. Because of this insight, you will have the ability to live within your means, refrain from overspending, and make certain that your financial resources are directed toward the achievement of your most essential financial goals.

Keeping careful track of your expenditures is a useful supplement to budgeting since it enables you to gain insights into your spending patterns in real time. Record every purchase, no matter how little it may seem, using tools such as spreadsheets or apps that manage expenses. Reviewing the data from your spending monitoring spreadsheet on a regular basis enables you to recognize patterns, recognize wasteful expenditures, and alter your budget appropriately.

If you make budgeting and keeping track of your expenses part of your regular financial routine, you will be able to regain control of your financial situation, alleviate some of the stress that comes along with it, and make progress toward a more secure and prosperous future.

Embrace mindful shopping!

The adoption of mindful purchasing is a potent method that may significantly improve one’s financial decisions, cut down on unneeded spending, and lead to a life that is both more sustainable and more satisfying. Shopping mindfully means giving careful consideration to each item you buy, taking into account how it will affect not just your finances but also the world around you and your state of health as a whole.

To begin the practice of mindful shopping, before you make a purchase, you should first set your goals clearly. Ask yourself if you truly require the item or if it is merely something you want out of impulse rather than a need. Take into account the purchase’s potential long-term worth as well as how well it fits in with your overall financial objectives.

Conduct careful research on available goods and opt for high-quality things that will serve you for a longer period of time and might end up saving you money in the long run. Compare the pricing, read the reviews, and look for solutions that are both sustainable and ethical wherever you can.

In addition, you should try to avoid engaging in retail therapy or making impulsive purchases as a means of relieving stress or negative feelings. Find other, more healthy methods to deal with your feelings and stress, preferably ones that don’t require throwing away money unnecessarily.

You will become a more conscientious consumer if you practice mindful shopping. You will also decrease clutter, save money, and make decisions that correspond with your beliefs and financial priorities. All of these things will ultimately lead to a life that is more purposeful and financially secure.

Avoid impulse purchases and stick to your shopping list!

A major method for keeping financial discipline and ensuring that your spending is in accordance with your financial goals is to adhere to your shopping list and avoid making purchases on a whim. This will help you avoid making impulsive purchases. Spending more money than you intended to as a result of impulse buys can rapidly mount up, leading to serious financial stress. The following is a list of reasons why it is critical to refrain from making rash purchases:

Your attempts to create a budget might be derailed by making impulsive purchases, which can lead to overspending in areas where you hadn’t originally intended to spend money. This helps you preserve your budget.

Reduces Clutter: Unplanned purchases frequently end up as clutter in your house, and clutter can have a bad influence on both your living space and your emotional well-being. Getting rid of clutter is one of the benefits of decluttering your home.

Money Saved: If you stick to your shopping list, it will help you save money by stopping you from making needless purchases of things that you may or may not actually need.

Creating a shopping list before going to the store and sticking to it will help you avoid making impulsive purchases. If you come across anything that piques your interest, take a minute to assess whether or not it fits in with your spending plan and the things that are most important to you. A better handle on one’s finances and a more thoughtful attitude toward purchasing may be achieved by developing self-discipline and cultivating awareness when out shopping.

Cook at home more often and embrace affordable, nutritious ingredients!

An approach that is beneficial to both your health and your budget is to cook at home more frequently and to make use of items that are both economical and healthy. When you cook your own food at home, you have a lot more say over what you put in your body and how much money you spend on it. The following are some of the reasons why this method is beneficial:

Spending a lot of money going out to restaurants or getting takeout on a regular basis may get pricey. When you cook meals at home, you may buy the products you need in larger quantities, take advantage of bargains, and end up saving money in the long run.

When you cook at home, you have more control over the ingredients you use, which means you may pick ones that are healthier and higher in nutrients. You have the ability to select meals that are better for you, adjust the portion sizes, and accommodate any dietary preferences or constraints.

Enhanced Capabilities in the Kitchen: Your abilities as a cook will naturally advance as you spend more time in the kitchen. You will develop greater self-assurance in the kitchen, and you could even find that you have a hidden passion for food preparation.

The act of preparing meals together at home may be a bonding experience for families as well as for friends and other social groups. It is a chance to get to know one another better while eating meals together.

Reduced Amounts of Food Thrown Away: When you prepare meals at home, you have more control over how you use the food you purchase, which results in less food being thrown away.

Begin with straightforward recipes, hone your abilities in the kitchen over time, and broaden your horizons to include inexpensive foods that are nevertheless high in nutrition. Some examples are whole grains, legumes, and veggies that are in season. You will, in the long run, not only save money but also experience improved health and a higher level of culinary satisfaction.

Plan meals in advance and reduce food waste by using leftovers!

You may save money, minimize your influence on the environment, and simplify your daily routine by planning meals in advance and decreasing food waste by utilizing leftovers. Both of these key activities can be accomplished by using leftovers. The following are a few reasons why these routines are beneficial:

The ability to shop wisely and get just the ingredients necessary for the scheduled meals contributes to greater cost efficiency. It helps you stay within a budget and reduces the number of times you make impulsive purchases. By putting your leftovers to good use, you may stretch the value of the food you purchase even further.

Organizing your meals in advance can help you save time and make your daily routine more manageable. It will take you less time each day to decide what you want to make, and you’ll be able to save time during the hectic weekdays by preparing in larger quantities.

Impact on the Environment: Reducing the quantity of unused food that ends up in landfills is one of the most important things we can do to help the environment. Methane, a powerful greenhouse gas, is produced when food is thrown away. Utilizing previously consumed food helps preserve resources and lowers an individual’s overall carbon footprint.

Using up what you already have in different ways might lead to the creation of innovative and appetizing new dishes. It gives you the opportunity to try out different flavors and combinations, which will make your diet more interesting.

Making a weekly food plan and a shopping list based on that plan is the first step in getting started. If you find yourself with extra food after a dinner, be sure to properly store it and include a night specifically for eating leftovers in your weekly meal plan. These habits will not only help you save money but will also encourage a more structured and environmentally friendly approach to the management of food.

Optimize your vehicle usage by using public transportation or carpooling!

To cut costs, lessen your impact on the environment, and improve the quality of your commute as a whole, it is wise and environmentally responsible to make the most of your vehicle usage by taking public transit or riding in a carpool wherever possible. The following are some convincing arguments in favor of your giving serious consideration to these choices:

Savings on prices: Taking public transportation or participating in a carpool can save you a large amount of money each month on transportation costs. It is a more cost-effective option since you will spend less money on gasoline, maintenance, and parking costs.

The environmental benefits of carpooling and taking public transportation include a reduction in the overall number of automobiles on the road, which in turn helps to lower levels of air pollution and emissions of greenhouse gases. It is a concrete way that one may contribute to the protection of the environment.

Traffic-related stress reduction: Traveling can occasionally be unpleasant, particularly when there is heavy traffic. Because you are able to read, get some work done, or just relax during the ride, taking public transit or carpooling can make for a less stressful and more pleasurable trip.

Carpooling encourages social contact and can assist in the development of a sense of community with other commuters, both of which are beneficial to everyone involved. Taking public transit can increase your sense of civic involvement by introducing you to a wider variety of individuals and bringing you closer to your community.

Explore the public transportation choices in your region and think about joining a carpool or ridesharing program if you want to get the most out of the time you spend driving. These choices will not only save you from losing.

Build an emergency fund and save for retirement as well as future goals!

Building an emergency fund and simultaneously saving for retirement and future goals are essential components of a sound financial plan. Each serves a unique purpose, ensuring financial security at different stages of life.

- Emergency Fund: An emergency fund acts as a financial safety net, providing you with a cushion to cover unexpected expenses like medical bills, car repairs, or job loss. It prevents you from going into debt during emergencies, offering peace of mind and financial stability.

- Retirement Savings: Saving for retirement is a long-term investment in your future financial well-being. It ensures that you can maintain your desired lifestyle when you no longer earn a regular income. Start early, take advantage of retirement accounts, and consider employer contributions to maximize your retirement savings.

- Future Goals: Beyond retirement, you likely have other financial aspirations, such as buying a home, funding your child’s education, or taking dream vacations. Saving for these goals in separate accounts ensures that you’re making consistent progress toward achieving them.

Allocate a portion of your income to each of these financial priorities. Balance your contributions based on your current financial situation and goals. By building an emergency fund, saving for retirement, and working towards future objectives simultaneously, you create a robust financial foundation that safeguards your present and secures your future.

In Conclusion!

Learning to live a more modest lifestyle and the associated life skills is a revolutionary path toward financial security, independence, and a more conscious way of life. You may gain control over your money and pave the road toward attaining your financial objectives if you grasp the significance of creating a budget, keeping track of your costs, and finding areas in which you can make cost-cutting adjustments.

You may guarantee that your spending is in line with your beliefs and priorities by practicing mindful shopping and avoiding making impulsive purchases. This also gives you the opportunity to make decisions that are more purposeful and responsible. Not only can you save money by preparing meals at home, but you can also encourage more sustainable and healthy eating habits by meal planning and cutting down on food waste.

Your pocketbook and the environment will thank you if you maximize the use of public transit or carpooling to reduce the number of times you have to use a vehicle. This will also make your commute more environmentally friendly. Last but not least, establishing a rainy-day fund, putting money away for retirement, and working toward future objectives give financial security and a path toward realizing one’s ambitions. You may experience financial peace of mind, decrease stress, and strive toward a brighter and more secure future if you incorporate these frugal living skills into your daily routine and make them part of your habit.