Taking the first step toward improving your financial situation is a brave move that will pay off in the long run. Keep in mind that every choice, no matter how small it may seem, contributes in some way to the direction your life takes. Maintain your steadfastness and resilience, and make the most of the opportunities to learn that arise. Remember that patience and self-control are your compass bearings, and act accordingly. Maintain a clear vision and keep your goals at the forefront of your mind, regardless of the ups and downs. Learn as much as you can, have an open mind, and adjust as necessary. Put yourself in an environment that is full of positive energy and people who share your values, as this will make your journey more enjoyable. Have faith in your skills, because the extent of your potential is virtually limitless. You are getting closer and closer to being financially independent with each step that you take. If you maintain an unshakeable level of confidence and keep going forward, your path will bring you the success that you so deserve.

| Table Of Contents |

| Understanding your financial starting point! |

| Assessing your current financial situation! |

| Identifying assets, liabilities, and net worth! |

| Tracking income, expenses, and savings! |

| Defining short-term and long-term objectives! |

| Creating a budget and financial roadmap! |

| Prioritizing goals based on importance and feasibility! |

| Embracing and exploring financial education! |

| In Conclusion! |

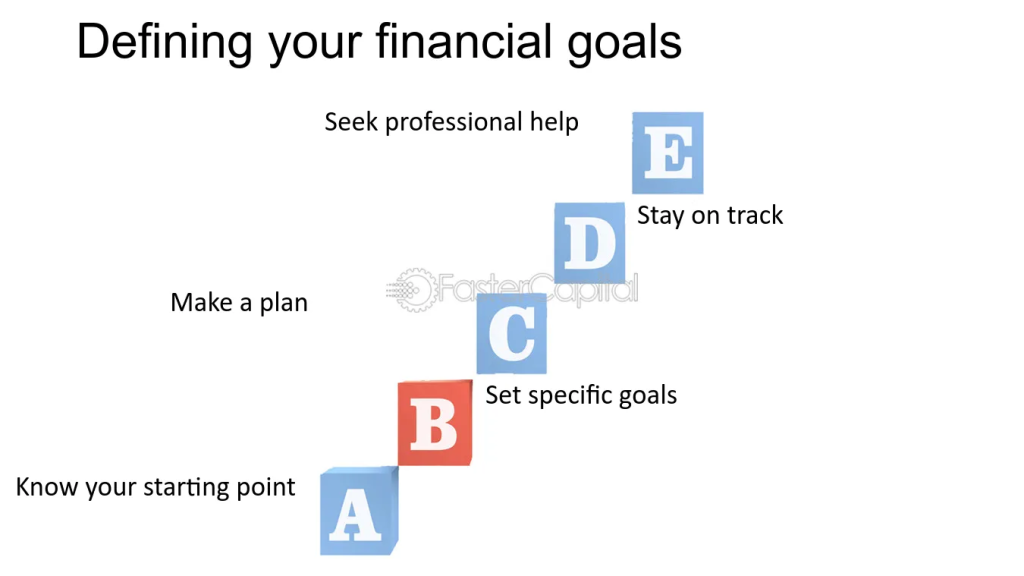

Understanding your financial starting point!

On the path to being financially savvy, the first and most important step is to have an understanding of your current financial situation. Before going on a journey, having this knowledge is analogous to having your coordinates marked on a map; it enables you to plot out a straightforward route forward.

First things first, conduct a careful analysis of your existing financial status. Make a list of all of your assets and obligations, including your assets (which may include your property, investments, and savings) and your liabilities (which may include your debts and outstanding loans). To get an idea of your total financial standing, you should determine your “net worth” by deducting your obligations from your assets. This will give you an indication of how healthy your finances are.

Next, make a record of the sources of your income and the costs you incurred. Make sure you keep careful track of where all of your money is coming from as well as where it is going. This can provide you with a better understanding of your spending patterns as well as areas in which you may be able to save or invest your money more intelligently.

You may develop a foundation of knowledge that enables you to establish attainable objectives, make well-informed decisions, and steer yourself toward a more financially secure future if you gain awareness of where you are financially right now. It is the foundation upon which the rest of your financial journey is built, giving you the ability to build upon your strengths and successfully handle any flaws you may have.

Assessing your current financial situation!

The process of evaluating your present financial status involves taking a picture of your overall financial landscape. This provides you with a distinct understanding of where you are at a specific point in time. In order to get started with this evaluation, you need to first make an exhaustive inventory of all of your assets and obligations. Your liabilities consist of debts, loans, and any outstanding financial responsibilities, whereas your assets can include cash, savings, investments, real estate, and personal property.

After you have tallied all of these numbers, you can determine your net worth by taking the difference between your total assets and your total liabilities. This number is a representation of your current financial condition, and it is an important indicator that can be used to track your growth over time.

You should investigate the sources of your money and the amounts you spend. Examine all of the components that make up your monthly income, such as salary, bonuses, income from rental property, and the like. Also examine your expenditures concurrently in order to identify the areas in which the majority of your cash is going. These expenses may be broken down into two categories: those that are required (such as housing, groceries, and utilities) and those that are optional (such as dining out or entertainment).

The results of this financial assessment will provide you with the knowledge and understanding you need to make educated decisions, establish objectives that are significant to you, and devise a practical financial strategy that is suited to your specific situation. It serves as the compass that points the way to financial stability and success on your path.

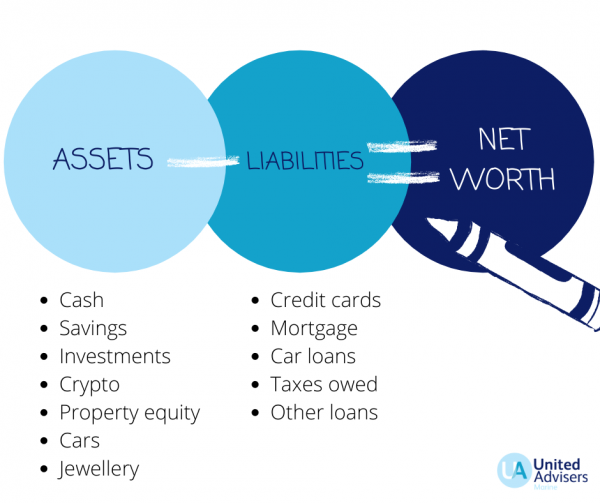

Identifying assets, liabilities, and net worth!

One of the most essential aspects of both financial awareness and planning is the identification of assets, liabilities, and net worth. Your cash, savings accounts, investments, real estate, automobiles, and personal goods such as jewelry and art are all examples of assets. Also included in this category is anything else you own that has monetary value. These assets may be divided into two categories: liquid assets, which can swiftly be turned into cash, and non-liquid assets, which are more difficult to convert into cash.

On the other hand, liabilities are the financial commitments or debts that you owe to other people. Mortgages, auto loans, credit card debt, outstanding school loans, and any other form of financial obligation might fall into this category. It is of the utmost importance to differentiate between short-term and long-term commitments, as well as to comprehend their respective interest rates and terms of payback.

The difference between the total value of all of your assets and all of your obligations is your net worth. It serves as an essential barometer of the state of your finances in general. If you have a positive net worth, it means that you have more assets than you do debts; if you have a negative net worth, it means that the reverse is true. Keeping track of your personal net worth over time allows you to measure your financial development and directs you in the direction of developing wealth and practicing appropriate financial management.

You may obtain a better understanding of your current financial situation and be in a better position to make decisions that will enhance your overall financial well-being if you routinely identify and evaluate your assets, obligations, and net worth.

Tracking income, expenses, and savings!

The most fundamental component of efficient financial management is the recording of one’s income, expenditures, and savings. It is like having a compass that directs you on your path with your finances.

When keeping track of your income, the first step is to document all of the many ways that you make money, such as your pay, the money you get from renting out space, the dividends you receive, and any other monetary inflows. This provides you with an accurate depiction of the amount of money that is consistently coming into your possession.

Keeping track of expenses requires documenting each and every expenditure, regardless of whether they are constant or changing. Expenses should be broken down into basic categories such as housing, utilities, groceries, and transportation, and discretionary categories such as going out to eat, spending money on entertainment, and spending money on hobbies. Keeping track of your expenses enables you to find areas in which you may save money and assists you in making more informed spending decisions.

Keeping tabs on your money is equally important. To calculate how much money you can put away each month, take into account all of your costs and deduct them from your income. Establish concrete objectives for your savings, such as the establishment of an emergency fund, the investment of funds in retirement accounts, or the saving of money for significant purchases.

Reviewing your income, spending, and savings on a regular basis gives you the ability to create an efficient budget, see emerging patterns in your finances, and make the necessary modifications to realize your financial objectives. If you take a preventative approach to achieving financial success, you may take charge of your own financial destiny.

Defining short-term and long-term objectives!

The process of defining both short-term and long-term objectives is a crucial component of efficient financial planning. Doing so will assist you in plotting a route for your financial journey that is in line with your goals and top concerns.

Short-Term Objectives: These are often financial objectives that you seek to attain in the near future, typically within one year or fewer. Long-Term Objectives: These are goals that you plan to reach in the far future. Building up an emergency fund, paying off debts with high interest rates, putting money away for a vacation, or making required repairs to the house are all examples of possible short-term goals. They are essential for attending to pressing concerns and laying the groundwork for more detailed financial planning.

Long-Term Objectives are those that look further out than the immediate horizon and often cover a period of time that is several years or even decades. These objectives include key life accomplishments such as accumulating savings for retirement, purchasing a home, providing for the educational expenses of one’s children, and achieving financial independence. To achieve long-term goals, you need to maintain your planning, maintain your discipline, and make regular contributions to your investments or savings accounts.

You will be able to successfully spend your resources and efforts if you differentiate between short-term and long-term goals. This will allow you to ensure that you are meeting both your current financial requirements and putting yourself in a position for a safe and prosperous future. Your overall financial well-being will improve as a result of using this well-rounded approach to goal planning, and your financial journey will seem more meaningful as a result.

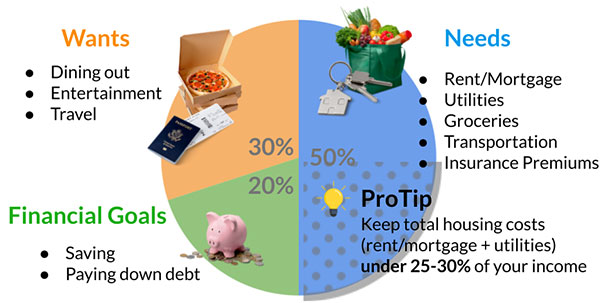

Creating a budget and financial roadmap!

Developing a spending plan and a financial road map is like plotting a course for your financial journey. Doing so will ensure that you continue on the right path and make headway toward achieving your objectives.

When creating a budget, you should first carefully record all of your income and then classify all of your spending. Having a budget gives you the ability to consciously allocate your money, allowing you to ensure that your spending stays within your means while still allowing you to save and invest. It gives you a clear picture of where your money is going and assists you in identifying areas in which you may make reductions or reallocations of resources in order to reach your financial goals.

Your financial roadmap is an all-encompassing strategy that specifies both your short-term and long-term monetary goals, as well as the actions that need to be taken in order to accomplish those goals. It contains methods for cutting down on debt, conserving money, making investments, and preparing for retirement. Your road map is an ever-evolving document that adapts to the new realities you face, and it acts as a compass to keep you on track with the goals you have set for yourself in terms of your finances.

When combined, a financial roadmap and a budget offer an all-encompassing perspective of your overall financial health and a methodical way to reach your goals. They provide you with the ability to make educated decisions regarding your finances, adjust to the various changes that occur in life, and strive toward achieving financial stability and prosperity.

Prioritizing goals based on importance and feasibility!

When it comes to properly managing your resources and securing a more stable financial future for yourself, one of the most important strategies you can use is to arrange your monetary objectives in ascending order of significance as well as practicality.

It is essential to understand that not all monetary objectives are created equal. Others may be more long-term goals, such as saving for retirement or purchasing a home, while others, like paying off high-interest debt or creating an emergency fund, may be more urgent. Putting your objectives in order of significance begins with determining which ones will have the greatest influence on your overall financial well-being and then working to accomplish those goals as soon as possible. This guarantees that you are addressing important financial difficulties as quickly as possible.

Consider the likelihood of achieving each objective as well as the steps necessary to do so. Consider aspects such as your existing financial condition, income, and costs, as well as the resources that are at your disposal. Put first priority on achieving goals that are doable given the resources you have at your disposal right now. Motivating yourself to keep going and preventing yourself from being overwhelmed are both benefits of setting objectives that are both reasonable and achievable.

You may construct a prioritized list of financial objectives by striking a balance between their significance and their practicality. This will help guide your activities and ensure that you utilize your resources properly, assisting you in making consistent progress toward achieving financial stability and success.

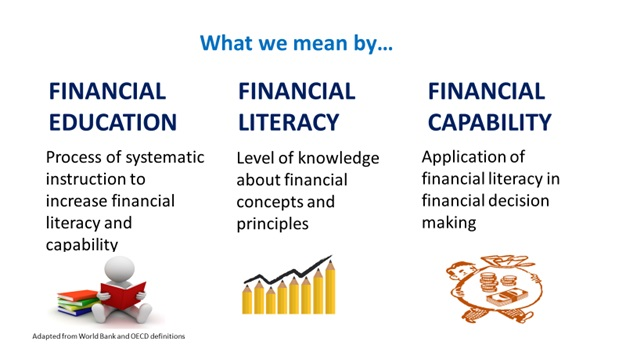

Embracing and exploring financial education!

A step toward making educated financial decisions and constructing a financially secure future is to embrace and investigate many aspects of financial education. This is an empowering step.

Recognizing the importance of Financial Knowledge and Literacy: The first step in embracing financial education is to recognize the importance of financial knowledge and literacy. Recognize that acquiring sound financial knowledge is an ongoing activity that can have a big effect on your overall financial well-being. Embrace it as a crucial instrument that will help you achieve your objectives and successfully navigate the difficult world of money.

Investigating Financial Education: Be proactive in looking for information that can help you enhance your understanding of finances. Reading books and articles about personal finance, going to financial seminars or webinars, enrolling in online courses, or consulting with financial professionals are all potential ways to do this. You might want to look at subjects like creating a budget, investing, putting money away for retirement, and handling debt.

You may empower yourself with the knowledge and abilities essential to making educated decisions about your finances if you commit to and investigate various aspects of financial education. You now have the ability to maximize the effectiveness of your financial strategy, reduce the likelihood of undesirable outcomes, and make progress toward achieving financial stability and success. It’s an investment in yourself that will continue to pay dividends for the rest of your life.

In Conclusion!

Your road toward financial wisdom is a transforming process that entails gaining awareness of your present financial status, establishing crystal-clear goals, and making educated decisions. The first step is to do an evaluation of your assets, liabilities, and net worth, which together form the basis of your financial situation.

Defining both short-term and long-term objectives gives your financial endeavors both direction and purpose. Constructing a budget and a financial road map serves as your guiding compass and ensures that you remain on course by laying out where you want to go financially.

Setting priorities for your objectives based on their relevance and the degree to which they may be achieved enables you to more effectively manage your resources and concentrate on the things that are most important. Your ability to successfully manage the intricacies of the financial world is directly correlated to the depth and breadth of your financial knowledge, which may be increased by embracing and investigating many aspects of financial education.

Remember that patience, discipline, flexibility, and tenacity are your friends as you travel through this trip. Maintain your drive and encourage yourself by surrounding yourself with positive people. Your monetary well-being is within your grasp, and with each step you take, you become one step closer to the success and security that are rightfully yours. Maintain a crystal-clear vision, strong resiliency, and unwavering confidence as you go forward in your quest for financial understanding.